Information on ISO 20022

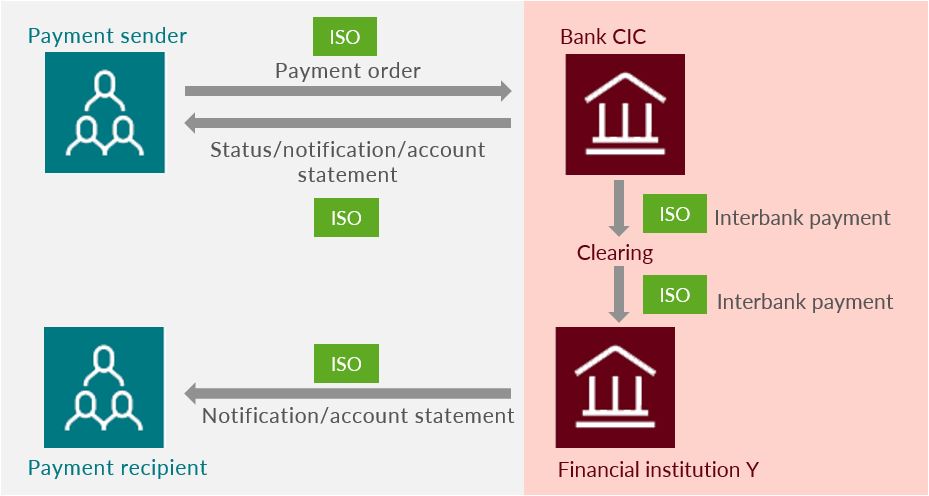

ISO 20022 is the new international standard for electronic data exchanges in the financial industry, which is assuming an increasingly key role worldwide, particularly in Europe. With the Swiss financial industry adopting this new standard, the varied mix of norms, procedures, formats and payment slips that currently makes up the payment system in Switzerland will soon be a thing of the past. In other words, ISO 20022 lays the foundation for more straightforward, more cost-effective payment processes with new, standardised formats for exchanging financial information between customers and their bank but also amongst the banks themselves.

The benefits at a glance

This is how harmonisation pays off for companies in Switzerland.

- Faster availability of funds, fewer costs

The unambiguous identification of the account number in IBAN format significantly reduces the number of entry fields, enquiries and returns by banks. This alleviates your administrative burden. - Lower IT investment and maintenance costs

Standardised payment orders and status messages at all Swiss financial institutions reduce the complexity required in a software solution. This relieves the strain on the IT budget. - Standardised validation of payments

A consistent validation of file submissions at all Swiss financial institutions increases processing quality. This saves time. - Enhanced process automation

The end-to-end payment process made possible through common standards enables the automatic recognition of a payment. This boosts efficiency. - New QR invoice enables improved automated scanning

On the new, uniform QR invoice, which replaces the payment slips previously in use, contents are always structured in the same way through the common standards used by the banks and PostFinance and can be conveniently scanned by means of a data code (QR code). This makes it simpler to enter payments. - Easier implementation of regulatory requirements

The new ISO 20022 standard makes it easier to implement regulatory provisions (by replacing the ISR procedure). This ensures security.

The main types of ISO message

The payment harmonisation process also involves introducing new message types for credit transfers, notifications, direct debits and payment slips. Like the European SEPA processes, these message types are based on structured XML messages that have been standardised by the International Organization for Standardization (ISO).

The following message types are now mainly to be used:

|

ISO message type |

Purpose |

Route |

|

pain.001 |

Credit transfers |

client > bank |

|

pain.002 |

Error/status reports |

bank > client |

|

pain.008 |

Direct debit instructions |

client > bank |

|

camt.052 |

Account report (intraday) |

bank > client |

|

camt.053 |

Account statement (end-of-day) |

bank > client |

|

camt.054 |

Credit advice / Debit advice |

bank > client |

See www.iso-20022.ch/lexikon/pain or www.iso-20022.ch/lexikon/camt for details.

The financial industry is to adopt these new message types gradually.

Good to know: ISO 20022 does not just apply to payments – it also covers areas such as securities, foreign trade and treasury operations.