Risk disclosure cleverinvest

This page provides information on the features, opportunities and risks of the investment product cleverinvest. The intention is to make investment decisions easier by explaining how it works and what makes it different. Our relationship managers would be happy to answer any further questions.

Features

cleverinvest aims to continuously build up your assets in an easy, cost-effective and uncomplicated way. Investors decide the equity weighting for themselves. Weightings of 20%, 45%, 70% and 95% are available. It is also possible to invest in gold or real estate within the equity weighting. In addition, there is a 5% liquidity weighting. The rest is invested in Swiss or European bonds (reference currency is EUR). Questions on risk appetite and risk capacity are used to create a personal investor profile. Based on this, the appropriate equity weighting is suggested to the client. The equity weighting can be changed at any time. The investment universe for cleverinvest consists of Exchange Traded Funds (ETFs) and index funds. Both ETFs and index funds are passive funds that replicate the relevant index (e.g. the SMI/MSCI Europe or the Swiss/European bond market) as accurately as possible. As part of the equity weighting, the client can invest individually in themes they find attractive. Depending on the investment theme, the underlying investment funds meet ESG criteria. The special risks in connection with sustainability (ESG risks) can be found in the brochure "Risks involved in trading financial instruments". If the reference currency is EUR, then EUR ETFs/index funds will be selected where they are equivalent. Where this is not possible, CHF ETFs/index funds will be used. The different themes are set by Bank CIC and may be adjusted in line with market developments. Within cleverinvest the client manages their assets independently and at their own responsibility. The different equity weightings mean the cleverinvest product may be suitable for various risk profiles. Depending on the composition, investors are recommended to adopt a medium to long-term investment horizon. The prices of investments may fluctuate, so appropriate allowance must be made for the liquidity needed to live on.

-

cleverinvest 20 – equity weighting 20%

This equity weighting is suitable for investors keen to invest with a high degree of security and keep price fluctuations as low as possible. Assets are therefore invested mainly in bonds. Recommended investment horizon: up to four years.

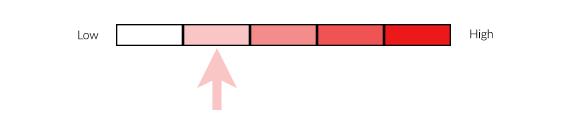

Risks and opportunities (risk classification)

Low risk and low opportunity for gains

-

cleverinvest 45 – equity weighting 45%

This equity weighting is suitable for investors keen to invest with a medium degree of security and who are prepared to accept increased price fluctuations. Assets are therefore invested roughly equally in equities and bonds. Recommended investment horizon: at least five years.

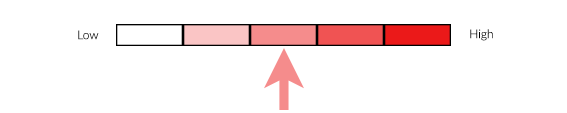

Risks and opportunities (risk classification)

Medium risk and medium opportunity for gains

-

cleverinvest 70 – equity weighting 70%

This equity weighting is suitable for investors keen to invest with a low degree of security and who are hence prepared to accept high price fluctuations. Assets are therefore invested mainly in equities and to a minor extent in bonds. Recommended investment horizon: at least six years.

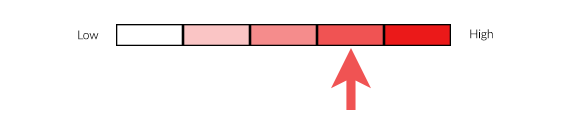

Risks and opportunities (risk classification)

Increased risk and increased opportunity for gains

-

cleverinvest 95 – equity weighting 95%

The equity strategy is suitable for investors keen to invest with a very low degree of security and who are hence prepared to accept very price fluctuations.

Assets are invested solely in equities. Recommended investment horizon: at least seven years.

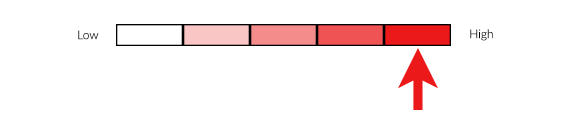

Risks and opportunities (risk classification)

High risk and high opportunity for gains

ETFs:

ETF stands for exchange traded fund. ETFs are managed passively. In contrast to actively managed funds, there is no active selection of investments by the fund. Instead, ETFs track an existing yardstick (benchmark) such as an index, without further analysing the weighting and investment motives. The main advantage is in the fee structure; costs are low because there is no active fund management. ETFs are also highly transparent (because they are traded on the stock exchange every day) and highly diversified (because they offer access to an entire market).

Index funds:

Like ETFs, index funds aim to track an index as accurately and cheaply as possible, and are also passively managed. The main difference between the two is the exchange listing. Unlike ETFs, index funds are not traded on an exchange. The price (net asset value, NAV) of each unit reflects all the investments of the index fund and is calculated by the fund company on a daily basis. Index funds can be traded in fractions, but ETFs can only be bought and sold in whole shares.

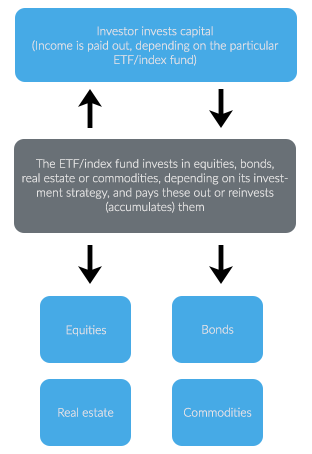

Both ETFs and index funds can invest in separate asset classes such as equities, bonds, real estate and commodities.

How ETFs/index funds work

Benefits of investing in passive funds (ETFs or index funds)

- Passive funds make it possible to diversify broadly across different countries, sectors, themes, indices and asset classes with small amounts of capital.

- Passive funds in particular also offer a way of investing easily and cheaply in megatrend themes to participate in their performance.

- Investors do not require any particular market knowledge, as the selection and management is taken care of by specialists. When investing, clients can select their own preferred themes.

- Should the investment company become bankrupt, the investment capital is protected as is it classified as 'special assets' and held by a separate custodian.

- Fund units can generally be converted into cash within a few days.

-

Risk of loss

The value of a ETF or index fund may fall below the purchase price. However, if a wide variety of underlyings are involved, the probability of a total loss is relatively low.

-

Market risk

Depending on the product, the possibility of selling an investment may be restricted because it is tied to certain trading venues or owing to time differences and opening hours. In negative market situations caused by political or economic events, the price performance of the investment may lead to a loss.

-

Currency risk

Products in foreign currency are exposed to the risk of devaluation against the investor’s base currency. This means that the foreign currency may fall in value against the investor's base currency and a loss may be incurred on exchanging it back, thereby lowering the overall return.

-

Political risks

Depending on region and product, investors may be exposed to political risks. This applies in particular to countries that have low political stability, as is often the case in poorly developed or emerging markets. Should internal unrest or economic disruption arise, this may have a negative impact on the value or availability of the investment.

-

Regulatory risks

Governments and associations can issue new laws or change existing ones. These changes can have an adverse effect on the investment. Furthermore, governments and regulatory authorities can suspend, ban or restrict trading on the stock exchange or another market.