Vested benefits account

Are you planning to give up your job and take an extended break? Or would you like to take some time out to reconsider your career? Our vested benefits account is the ideal solution for you until you join another pension fund or draw your vested benefits.

Your benefits at a glance

- An easy way to keep your pension assets safe

- Enjoy opportunities for higher returns by investing in retirement funds

- Getting an overview of your assets is quick and easy 24/7 thanks

to CIC eLounge - Assets (including interest) tax-exempt for the entire term

- Maximum security thanks to the OPA

Overview of terms

- Vested benefits account: The current interest rate can be found in the overview of account interest rates.

- Retirement funds: All-in fee of 0.5% p.a. of fund value*

*Minimum CHF 50 p.a., debited annually on 31.12. or when the retirement account is closed. Calculations are based on the fund value on the 25th of each month. Clients domiciled in Switzerland or the Principality of Liechtenstein also have to pay value added tax.

Invest in funds

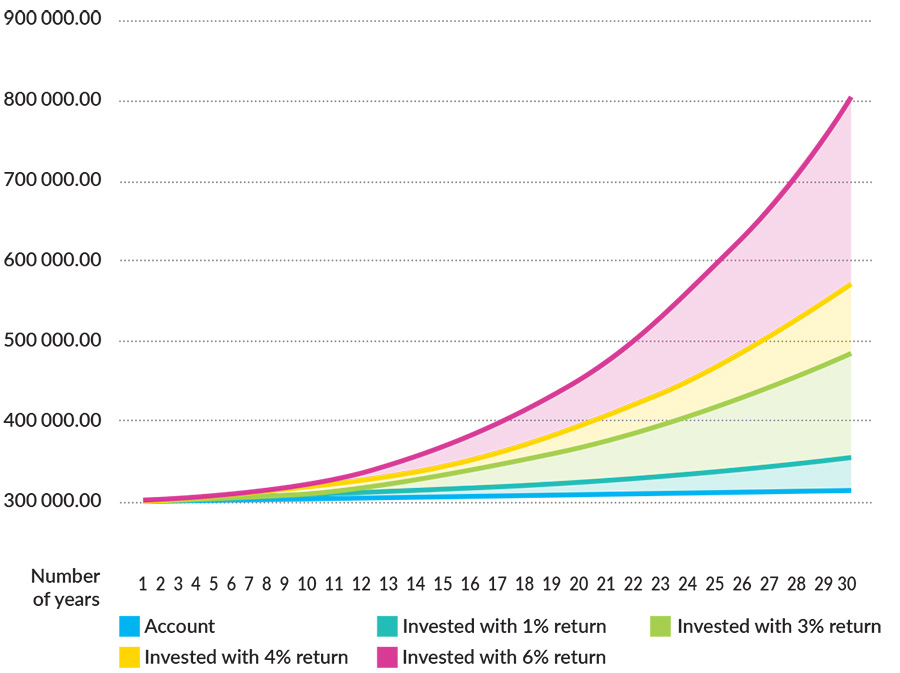

In addition to the vested benefits account with a fixed interest rate, you can also invest some or all of your vested benefits in retirement funds.

Which solution best fits your needs depends largely on how long your savings can remain invested.

- Are you planning to change job or take an extended break? A vested benefits account is suitable if you withdraw your vested benefits again within four years.

- For longer-term savings goals, putting your vested benefits in a retirement fund is an attractive alternative. The basic investment principle is: the longer you can leave your money invested, the higher your prospects of return.

Retirement funds

Our retirement funds invest in equities, bonds, real estate and other asset classes. Our wide offering lets you choose between over 30 different retirement funds from varying providers. Investing some or all of your vested benefits in a retirement fund multiplies your return opportunities.

Have you found the retirement fund that suits you? Once your vested benefits have been paid in you can buy funds directly in CIC eLounge. Or would you like some advice first? Contact us for a non-binding consultation. We will be happy to help you find a solution that is just right for your individual needs.

Open a vested benefits account now

If you don’t yet have an account with Bank CIC, it’s easiest if you contact our advisory team. Would you like to transfer your vested benefits to Bank CIC? Just use our simple transfer form.

Conditions of opening

A vested benefits account can only be opened in combination with a private or savings account or a cleverinvest portfolio.

CIC eLounge

CIC eLounge is the modern e-banking solution from Bank CIC. It gives you a quick and easy overview of your assets. You can also buy and sell retirement funds free of charge at any time. For maximum flexibility, CIC eLounge is available 24/7 as an app and a desktop version.